Implications of and potential mitigation methods for U.S. and International Tariff Adjustments from tax and switch pricing views

Overview of Tax/Switch Pricing Challenges

The just lately proposed will increase in US tariffs on imports from Canada, Mexico (albeit presently paused) China and the EU, amongst others, launched by the Trump administration, and the anticipated response from these jurisdictions impacted by the proposed US tariffs may have a number of switch pricing implications which multinational enterprises (MNEs) ought to take into account. These tariffs can result in elevated prices, potential double taxation points, and challenges in sustaining compliance with the arm’s size precept when items are transferred throughout the border between associated enterprises.

A key query to keep in mind is: Which entity carries the elevated value attributable to tariffs?

The fundamental thought is that the elevated value is handed on to the top buyer within the type of a rise of the client value of the affected items. Nonetheless, this isn’t attainable in all circumstances. In such circumstances, the query is which entity inside the provide chain ought to carry the elevated value, whereas making certain that the elevated value remains to be tax deductible and the therapy of the elevated value is consistent with the arm’s size precept and the group’s established switch pricing coverage.

There are some methods for MNEs to mitigate the affect of the of the usage of tariffs by:

- Restructuring the availability chain via e.g., relocating manufacturing operations. A lot of these enterprise restructurings usually have numerous tax, regulatory and employment implications, so if a provide chain restructuring is taken into account to mitigate the affect of tariffs, tax, regulatory and employment points must be addressed as a part of the planning; and

- Looking for to cut back the dutiable base for customs functions for intercompany transactions by e.g., excluding non-dutiable parts from the switch value or, the place attainable, diverging from the usage of switch pricing for customs functions and utilizing various customs valuation strategies.

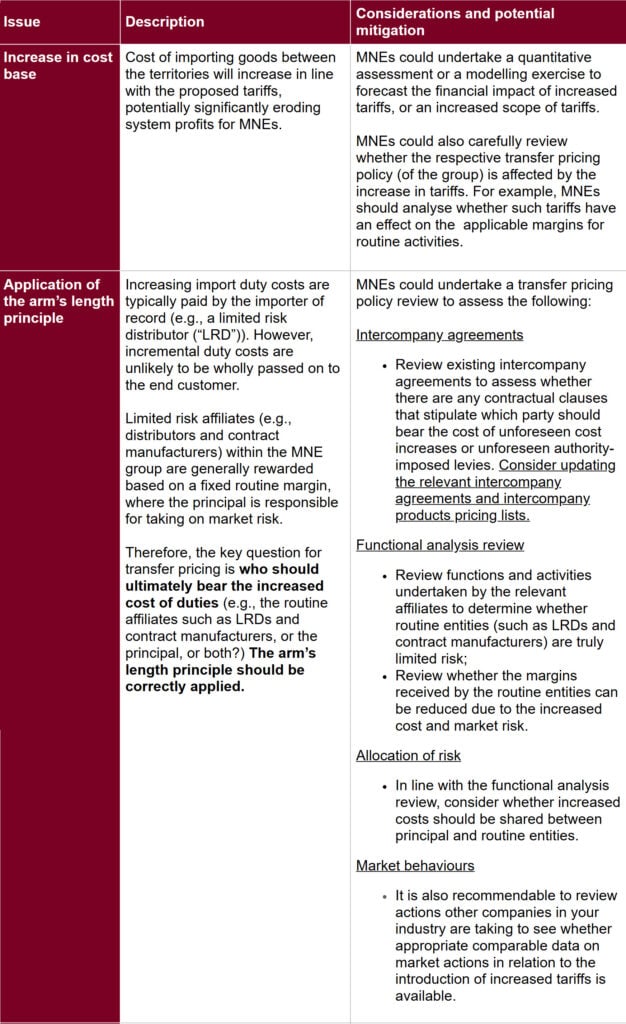

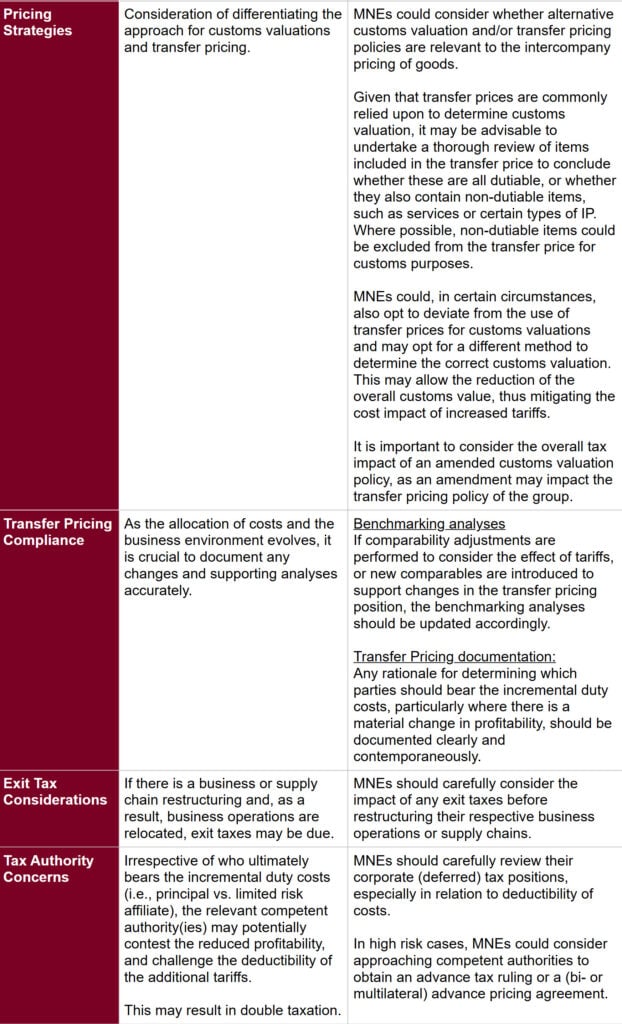

Key impacts, potential mitigation methods and concerns

The next abstract desk gives an outline of some the important thing impacts, potential danger mitigation methods and concerns.

The Baker McKenzie switch pricing professionals can help you in evaluating your current switch pricing insurance policies in mild of the elevated danger of further tariffs. We will additionally present help in quantifying the affect of any improve in relevant tariff price in your efficient tax price and customs prices. We’re skilled with partaking with tax and customs authorities in relation to APA and ATR help, in addition to offering normal recommendation on potential danger mitigation methods.