On 9 July, or probably sooner, Trump will resolve whether or not to reapply his so-called reciprocal tariffs to nations presently ‘benefiting’ from a decrease 10 per cent fee.

For these wanting reminiscence, a reminder:

-

On 2 April, Trump issued an government order imposing a ten per cent baseline tariff on all imports, supplemented by further country-specific “reciprocal” tariff charges for those who run giant commerce surpluses (in items) with the US. (Sure, truly simply the results of a foolish equation.)

-

For instance, the US’s reciprocal tariff on the EU can be 20 per cent, Japan 24 per cent, Indonesia 32 per cent, India 26 per cent, and many others. You could find the total record beginning on web page 20 of the related Federal Register discover.

-

The ten per cent baseline tariff got here into impact on 5 April. Nevertheless, after briefly coming into impact within the morning, later within the day on 9 April, Trump paused the upper reciprocal duties for 90 days, ostensibly to permit nations to barter. (He additionally hit China with a better tariff fee for retaliating, which has led to its personal particular saga, however that’s a narrative for an additional publication.)

So right here we’re. Liberation Day 2.0 is quick approaching. What comes subsequent?

I believe there are three buckets a rustic may fall into

-

Deal. Nations on this bucket do a deal with the US to maintain these specific tariffs as near 10 per cent as potential. These offers may additionally handle different US tariffs, such because the “nationwide safety” tariffs on vehicles, metal, and aluminium, however equally, they may not. To this point, the one deal to deal with the reciprocal tariff fee **seems** to be the one the US simply kinda did with China, which retains the reciprocal tariff at 10 per cent (albeit then topping up with a 20 per cent fentanyl-related tariff, and a load of different legacy duties). [Note: the UK deal says nothing about the reciprocal rate because the UK is subject to the baseline 10 per cent regardless.]

-

Delay. Some nations may not fairly get a deal, however they may get a reprieve. One other 90 days to work issues out with Trump. And you understand what … take it.

-

FAFO. Look, Trump would possibly simply resolve to whack a number of nations with the upper fee. Particularly now that Trump is aware of everybody is asking him a “hen”.

In order that’s all fairly apparent.

The actually enjoyable sport is making an attempt to guess which nations will fall into which bucket …

Provided that No one Is aware of Something (TM Alan Beattie), as a substitute of considering critically in regards to the deserves of every nation’s particular person case, I’ve determined to concentrate on **how** folks within the US administration would possibly do it.

The reply: ask the web.

So in true WWDTD (What Would Donald Trump Do) style, I requested ChatGPT the next questions:

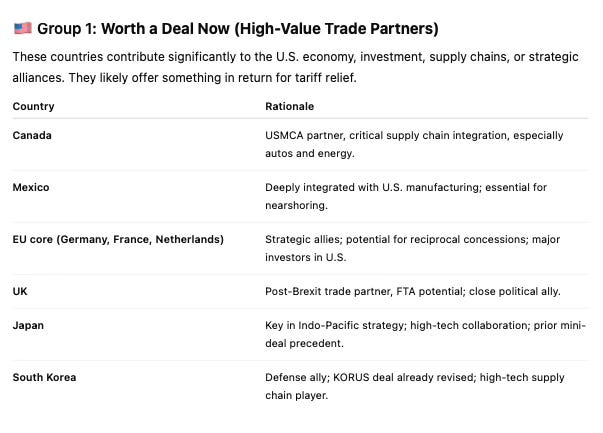

Which nations are worthy sufficient to deserve a deal forward of Trump’s 9 July tariff deadline? Which nations are negotiating in good religion and deserve extra time? Which nations should be whacked with increased tariffs?

And the web got here again with the next groupings …

Annnnnnd, sorry Indonesia, I suppose?

[As an aside, contra The Internet, I think there’s a pretty decent chance the EU gets whacked with 20 per cent. At least for a bit.]

I just lately found that a variety of Canadians learn this text.

So, to deal with that, there’s one thing I must get off my chest.

Canadians, please, please, please … cease calling USMCA “CUSMA”.

Please.

I’ve talked about the UK’s cope with the US already. Apparently, it’s going to be applied quickly.

Its headline profit for the UK is a tariff-rate quota permitting 100,000 automotive exports a yr to be topic to a US tariff of 10 per cent, fairly than 25 per cent.

One of many yet-to-be-answered questions is how the US will decide whether or not the automotive export is from the UK or not. (Sure, I’m about to speak about guidelines of origin once more.)

The obvious method is to use the US’s non-preferential origin regime.

Which means vehicles from the UK would qualify as long as US customs determines that “the final nation by which it has been considerably remodeled into a brand new and totally different article of commerce with a reputation, character, and use distinct from that of the article or articles from which it was so remodeled” is the UK.

This method is fairly vibes-based, however you’ll assume that UK exporters of vehicles that the US thinks of as being from the UK will be capable of profit from the quota’s decrease fee.

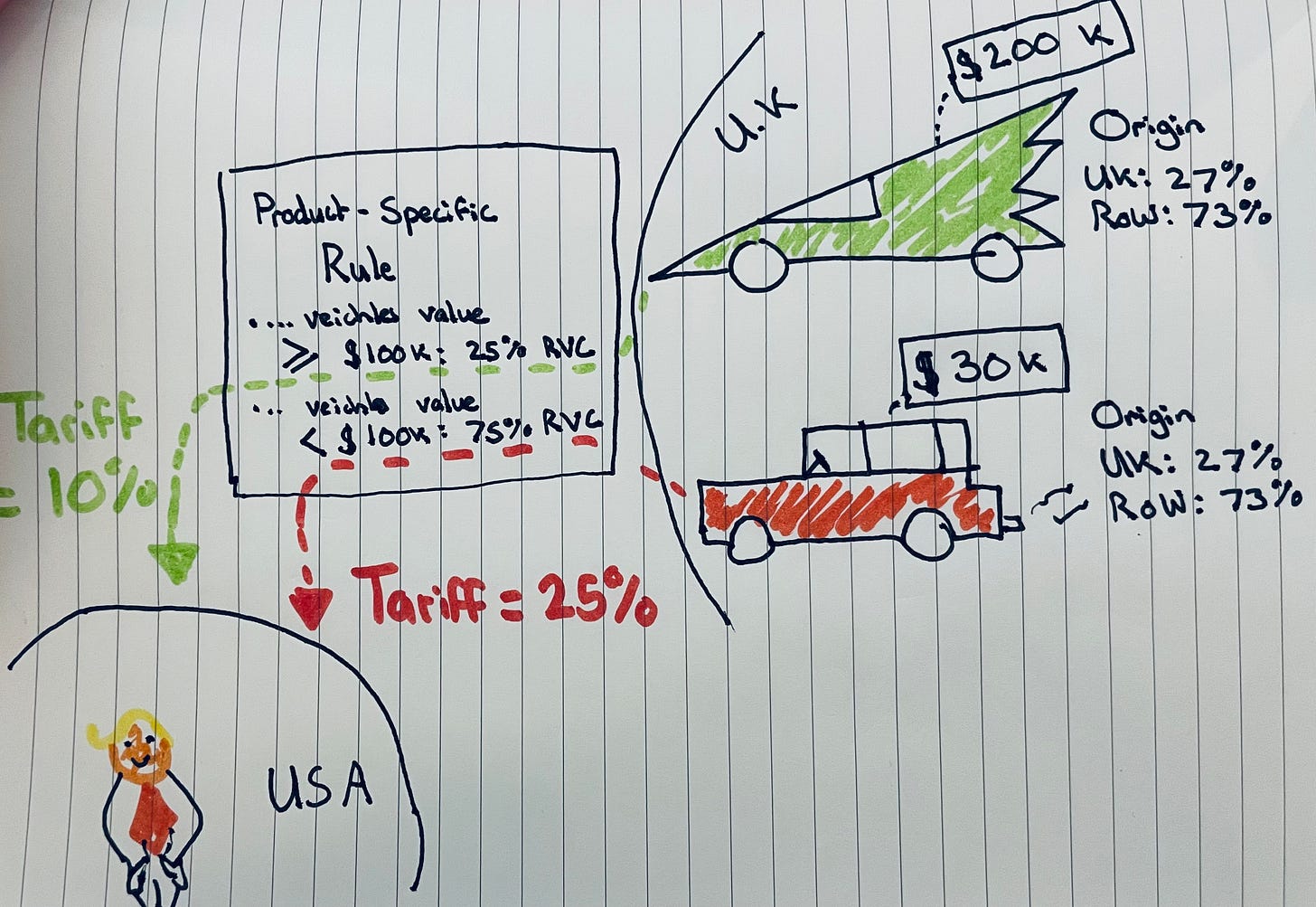

The choice can be some type of product-specific rule, of the kind usually present in free commerce agreements.

The issue with this method is that the US’s regular standards figuring out how a lot worth have to be created in an FTA companion’s market is WAY too restrictive for the UK.

For instance, USMCA (once more, by no means ever “CUSMA”) will ultimately require 75% of the worth of vehicles imported from Canada and Mexico to have been created within the area (plus a load of different stuff), whereas the UK efficiently negotiated the equal determine right down to 25% in its latest free commerce settlement with Australia to account for a way little auto value-add is created within the UK. (Thanks, pan-European provide chains.)

So … how would you bridge this hole?

One choice can be to use a worth threshold to the rule. For instance, autos valued at lower than $100,000 may face a extra restrictive rule (e.g. 75% RVC) than these valued at over $100,000 (e.g. 25% RVC). This might additionally align with the US’s concentrate on the deal being for “luxurious” autos.

Given you all inform me you like my finances drawings, right here it’s in image type:

However yeah … this method may get messy shortly and result in bizarre switch pricing, so it is not essentially ideally suited.

Greatest,

Sam