Estimating the attainable influence of tariffs on imports requires you to make an assumption concerning the so-called commerce elasticity.

For instance, if a ten% tariff improve is assumed to result in a 5% discount in imports, then the commerce elasticity is 0.5. If a ten% tariff improve results in a ten% discount in imports, the commerce elasticity is 1.0. If a ten% tariff improve results in a 20% discount in imports, the commerce elasticity is 2.0.

And so forth.

Clearly, totally different merchandise have totally different elasticities. For instance, if the product is very easy to substitute both domestically or from elsewhere, then you definately would count on the commerce elasticity to be excessive.

Alternatively, if the merchandise is crucial and you’ll solely get it from the one place you’ve got at all times imported it from then a tariff improve would have much less of an influence on imports, and the elasticity can be low.

Saying that, good individuals inform me {that a} affordable mixture elasticity assumption is round 2.0.

Nonetheless, the precise stage, assuming it’s above 1.0, turns into moot as soon as tariffs rise hit 100% and over.

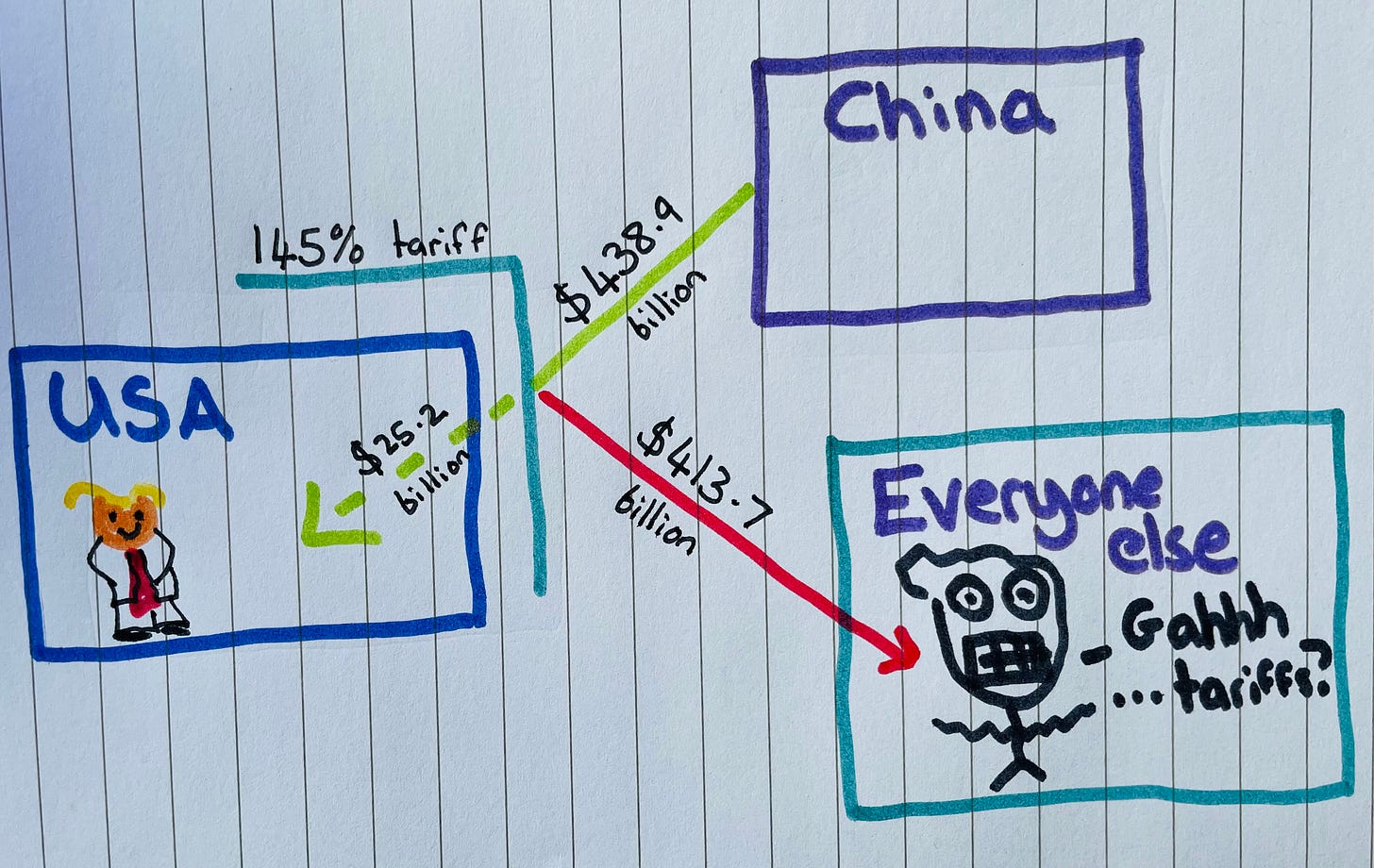

Let’s take, for instance, Trump’s new 145% tariff on China.

If you happen to assume an elasticity of 1.0, a 145% tariff will end in US imports from China dropping to (sub) zero.

And assuming the US isn’t going to cease importing stuff from China solely, a tariff of 145% most likely means you might be left with an elasticity of round 0.65. That is unfathomably low/conservative, nevertheless it nonetheless leads to practically all imports being worn out.

Utilizing 2024 import numbers, and assuming a commerce elasticity of 0.65, this implies US items imports from China will fall from $438.9 billion to … $25.2 billion.

So yeah, beneath probably the most conservative assumptions attainable, at present tariff ranges, we’re speaking about China-US items commerce collapsing.

Which is completely wild.

Anyway, my follow-up query is: What occurs to the c$413 billion of Chinese language exports that may now not enter the US? The place do they go? What are the second-order penalties?

I believe there are two apparent solutions.

In response to being shut out of the US market, Chinese language exports both …

-

Get diverted away from the US and into different markets. On the one hand, this implies a number of low-cost stuff for everybody else, on the opposite, producers in these markets will most likely freak out and foyer their very own governments for protecting tariffs. [Note: this is what happened in Trump 1.0 when he imposed the steel tariffs, and the EU and others, fearing a flood of cheap steel onto their markets, did the same.]

In image kind:

-

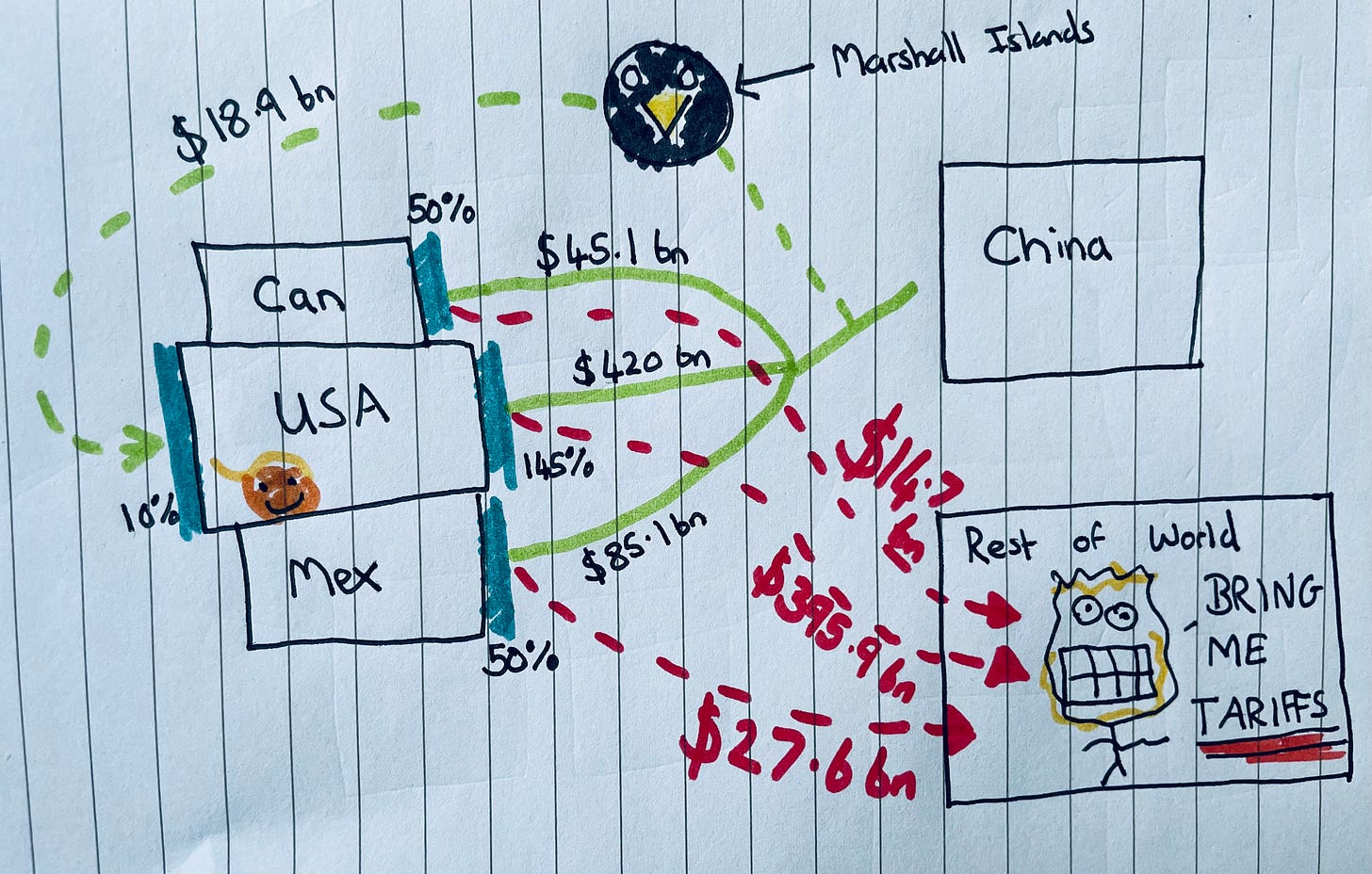

A few of the Chinese language exports would possibly discover their method into the US through different markets, for instance Cambodia, Vietnam, Mexico, and the Heard and Macdonald islands. (Sure, that is my guidelines of origin-related situation that I are inclined to badger on about … so much.) To forestall this from taking place, the US will most likely (and seemingly **is**) drive different international locations to limit Chinese language commerce and funding as a situation of sustaining a decrease US tariff charge.

In apply, this suggests extra tariffs on China by others, extra commerce diversion, and extra subsequent strain on international locations to impose their very own tariffs to protect towards Chinese language merchandise being diverted onto their market.

Right here it’s in a [much more complicated] image format, the place I assume that Canada and Mexico impose their very own tariffs on China too, however on the comparatively decrease charge of fifty% (however assume identical commerce elasticity [0.65], though it might undoubtedly be greater).

Can we assume the remainder of the world will soak up circa $438 billion in diverted Chinese language exports with out kicking up a fuss?

I think not.

All of that is to say that even when we assume the US-China tariffs (and I’ve simply mentioned the US aspect of this at this time; China has imposed its personal retaliatory tariffs too) come right down to barely extra smart ranges, the remainder of the world goes to return beneath a number of strain to introduce their very own tariffs each to guard home industries from diverted Chinese language competitors, and since the US is asking/forcing international locations to take action.

Have an awesome weekend!

Sam

P.S. If I’ve tousled a few of the sums … sorry. However you’re studying one thing written by a man who actually communicates utilizing felt tip pens. In order that’s kinda on you.