In the event you’re an exporter, there are worse issues on this planet than tariffs.

A tariff is a further value when promoting right into a market. This can lead to your product being much less aggressive (tariff value handed onto the buyer), your organization making much less cash (tariff value absorbed by way of decrease revenue margins), your employees being irritated (tariff value handed onto the labour drive by way of wage suppression), your suppliers being sad (tariff value handed onto the provider down the availability chain), or a mixture of all the above.

However the level is {that a} tariff doesn’t [neccesarily] stop you from exporting your product.

So what’s worse?

Nicely, somebody telling you that, for no matter purpose, you aren’t allowed to promote your product right into a sure market.

This might be as a result of your product doesn’t adjust to native laws (for instance, Canadian beef produced with hormones can’t be bought within the EU or UK), the product or firm being sanctioned, or as a result of the product being exported is topic to export controls.

On this occasion, the affect is much more binary: sure/no.

Given this, it’s price contemplating which sectors is likely to be most uncovered to the brand new EU compelled labour regulation, which went stay yesterday (12 December 2024).

The regulation states that from 14 December 2027, “financial operators” shall be prohibited from inserting merchandise made with compelled labour on the EU market and from exporting them from the EU. Firms discovered to have breached the regulation could also be required to take away the offending product from the EU market and doubtlessly destroy it in a pillar of fireplace.

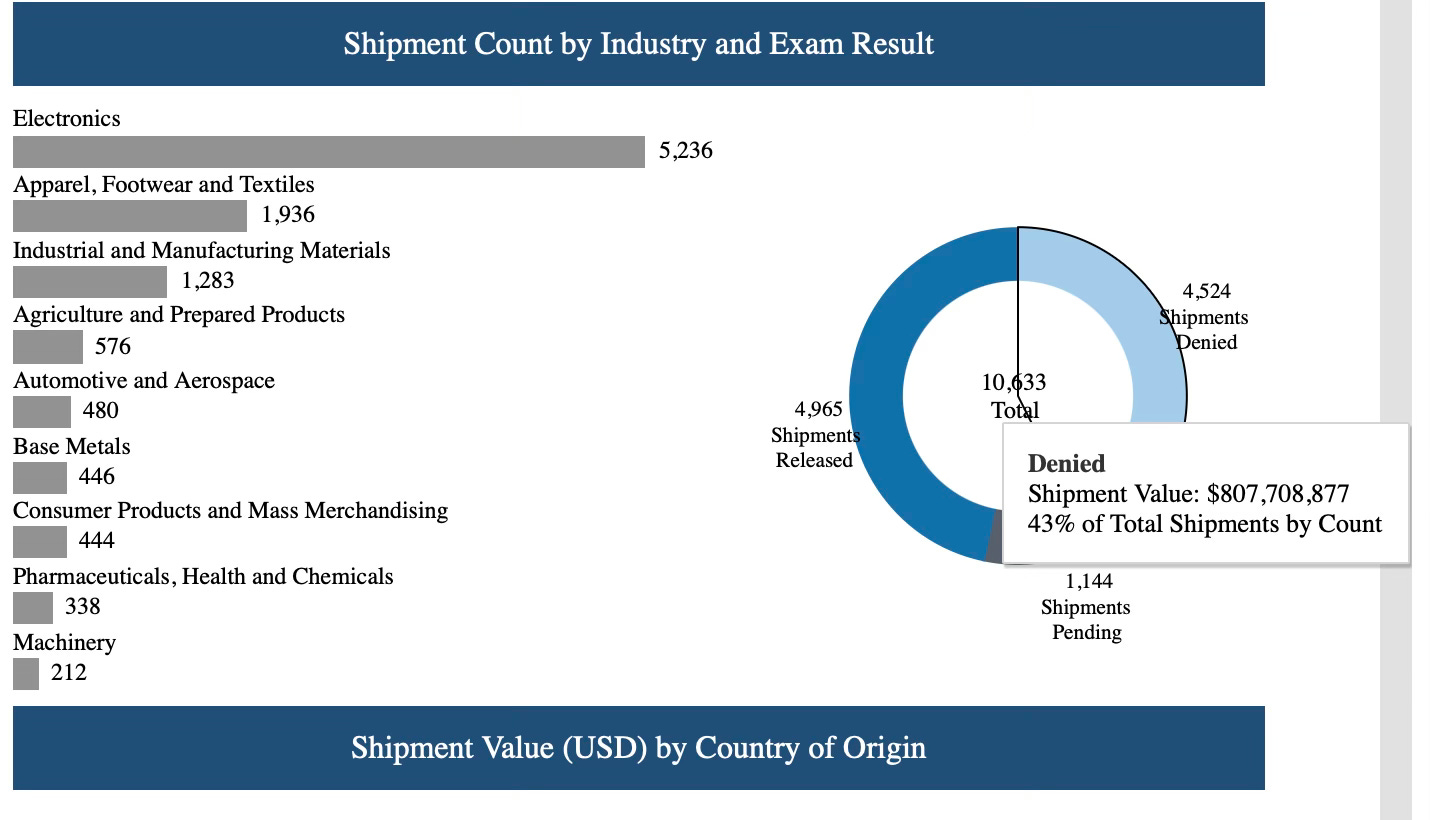

Given this regulation has some parallels with the US’s 2021 Uyghur Compelled Labor Prevention Act, we have already got an preliminary view of which sectors are getting caught:

Inside these broad classes, we additionally know there may be vital scrutiny of electrical automobile batteries and photo voltaic.

One notable distinction between the EU regulation and the US regulation is that the EU regulation is far broader. The US guidelines apply completely to merchandise linked to compelled labour in Xinjiang, whereas the EU guidelines apply to all merchandise no matter their nation of origin.

This widens the attainable product and geographic scope fairly significantly.

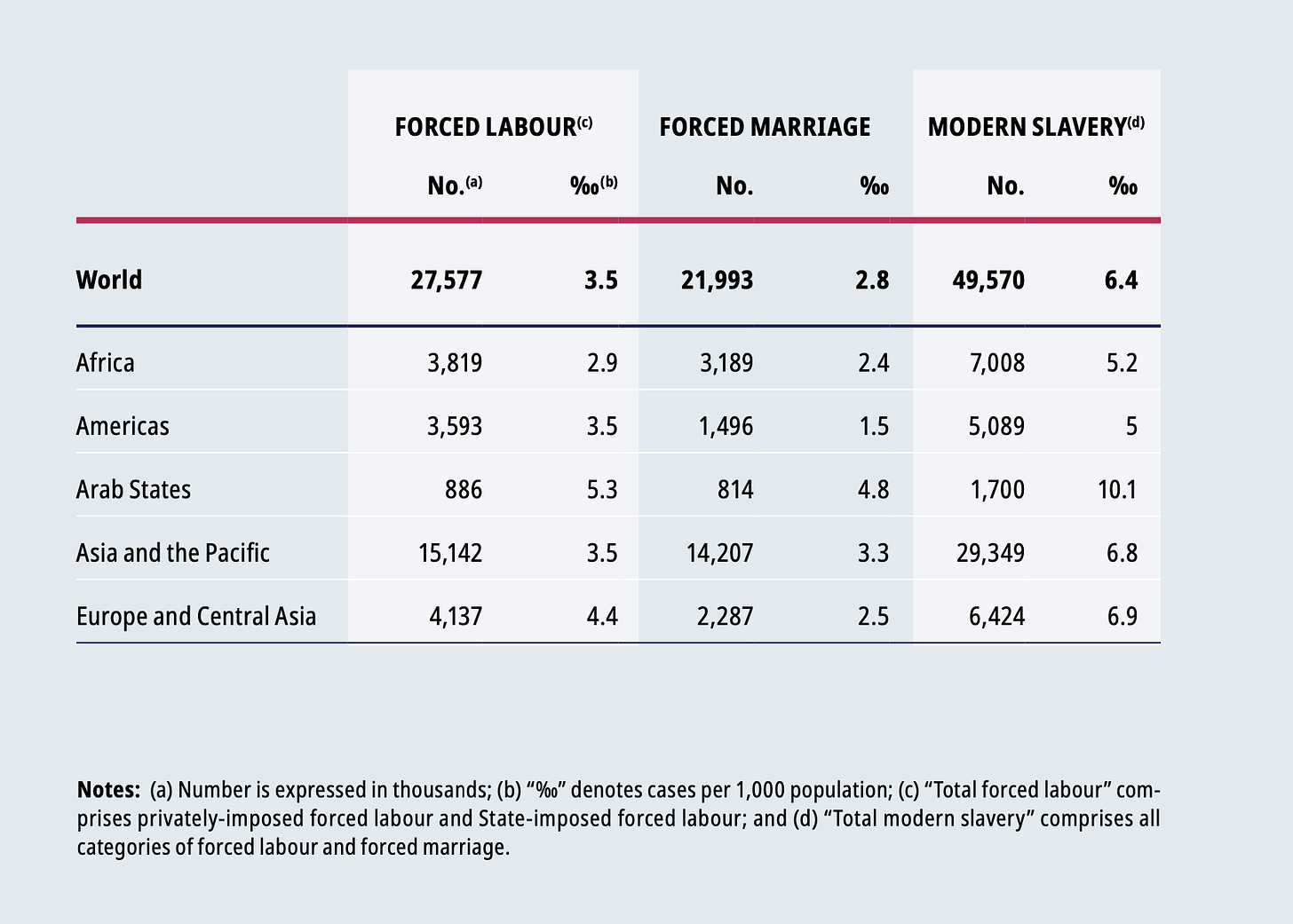

In keeping with the ILO, compelled labour happens … just about in every single place:

Nonetheless, there may be one other essential distinction between the EU and US approaches, which can soften the affect on the border.

Within the US, merchandise linked to Xinjiang are presumed to be linked to compelled labour until the importer can show in any other case. Underneath the EU regulation, the burden of proof shall be positioned on “competent authorities” (see: whoever every member state duties with imposing the regulation or the Fee, relying on the context) who might want to present proof of hyperlinks to compelled labour earlier than taking motion.

In observe, I think about compiling the proof and finishing an investigation shall be pretty time and resource-intensive, limiting the regulation’s utility.

Nonetheless, forward of entry into drive, some EU sectors are already campaigning for the restriction of overseas merchandise, so there could also be just a few high-profile scalps early on.

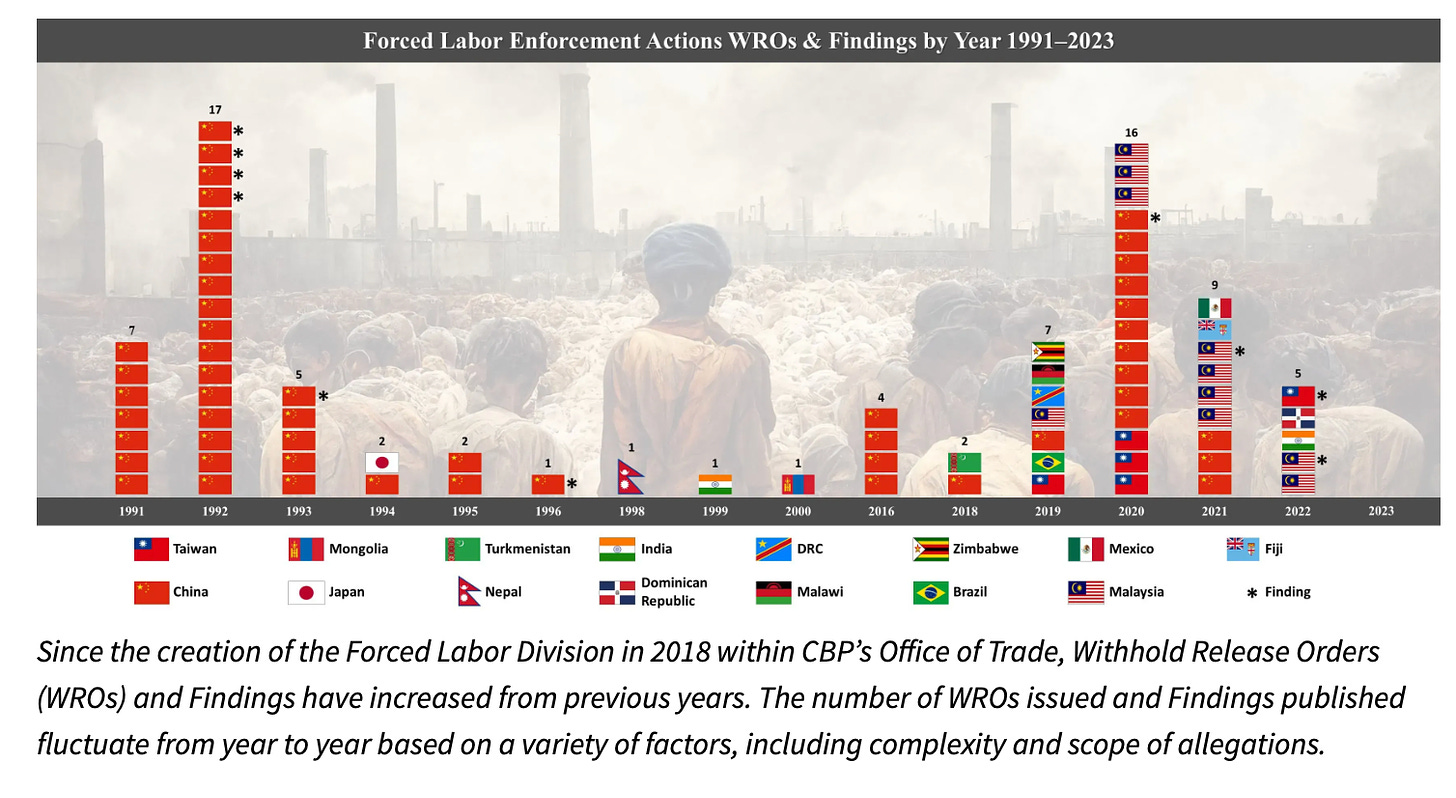

Replace: A few readers have written in to say the higher US/EU compelled labour comparability is with the US’s Withhold Launch Orders (WROs). WROs apply extra broadly than the Uyghur Compelled Labor Prevention Act however the burden of proof is just like the EU laws. I feel that is honest — I ought to have accomplished this. However the level on burden of proof nonetheless holds — if persons are anticipating the EU compelled labour regulation to have an analogous affect to the US Uyghur Compelled Labour Prevention Act (4,524 shipments denied!), I feel they’re incorrect. However sure, the variety of enforcement actions might definitely look just like the WROs:

The EU has lastly concluded its FTA negotiations with the Mercosur commerce bloc (Argentina, Brazil, Paraguay and Uruguay) … once more.

I’m fairly sceptical that this settlement with ever enter into drive, however placing that apart for a second, it’s in all probability useful to consider the affect of the deal if it does.

The very first thing to say is that it’s kinda a giant deal, actually.

As a rule of thumb, a commerce settlement shall be economically vital if the nation (or international locations) you might be negotiating with a) has plenty of folks and b) has excessive obstacles to commerce.

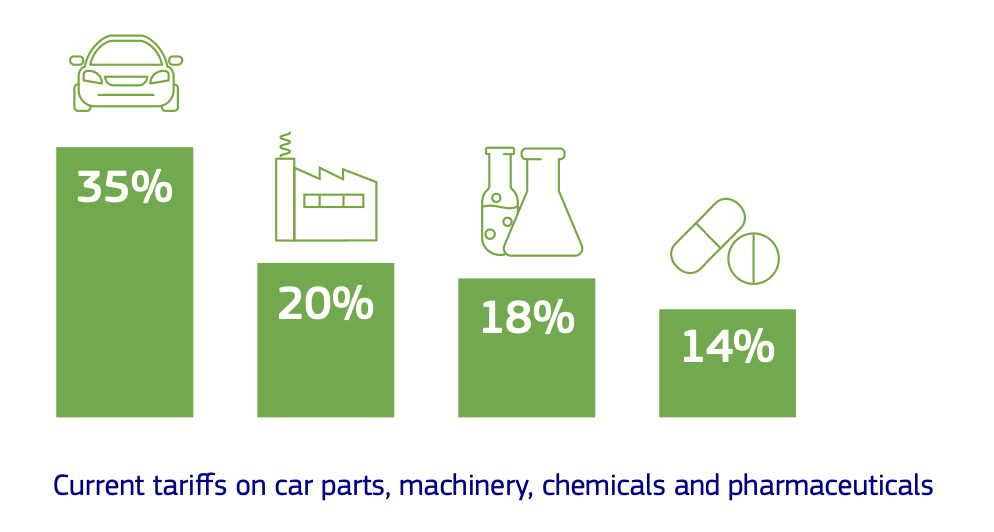

In keeping with Google, simply accounting for Brazil in Argentina, we’re speaking a few mixed inhabitants of over 250 million folks and utilized tariffs are excessive.

So yeah, cool.

Though for EVs, for instance, the tariff phase-out may take a short while:

It’s additionally price fascinated about whether or not the settlement might set off different international locations making an attempt to get in on the sport.

It’s because an FTA comparable to this not solely makes EU exports to Mercosur extra aggressive in comparison with home Mercosur producers but in addition extra aggressive than exports from, say, the US and UK.

So, who’s subsequent?

Former DG Commerce negotiator Ignacio García Bercero and his new colleagues at Bruegel have written a new paper brainstorming the attainable EU response to Trump tariffs.

It’s price learn the entire paper to get an concept of attainable EU pondering, however this proposal jumped out [emphasis added]: