The invasion of Ukraine in February 2022 prompted the US Treasury Division to impose unprecedented sanctions on Russia, to carry it “accountable for its premeditated and unprovoked invasion”.

The goal was to forestall Russia from “prop[ing] up its quickly depreciating forex by limiting international provides of the ruble and entry to reserves that Russia could attempt to alternate to assist the ruble”. In different phrases, Russia wouldn’t be capable to promote sufficient US {dollars} within the overseas alternate market to purchase up Russian forex and bolster its worth.

Certainly, US secretary of the treasury Janet Yellen known as this an “unprecedented motion” that may “considerably restrict Russia’s skill to make use of property to finance its destabilising actions”.

Freezing a sovereign nation’s greenback holdings (Russia’s on this case) is a seismic occasion. It dangers accelerating a transfer away from use of the US greenback for commerce or funding by international locations which have completely different geopolitical pursuits than the US, reminiscent of China or the Gulf states.

In truth, a number of governments outdoors the west are exploring methods to cut back their publicity to the greenback. Russia is presently settling 1 / 4 of its worldwide commerce utilizing Chinese language renminbi, and its bilateral commerce with China is sort of solely settled within the two international locations’ respective currencies.

In March 2023, China settled a cost for UAE gasoline in its personal forex somewhat than US {dollars} for the primary time. Then in November, China and Saudi Arabia signed a forex swap settlement, citing a need to broaden the usage of their currencies.

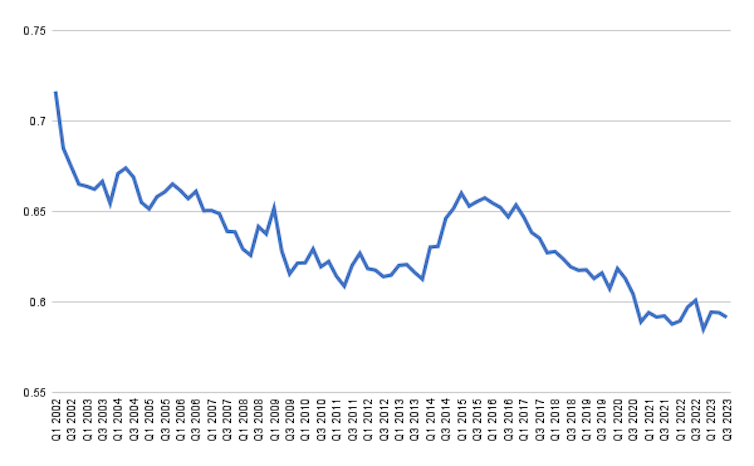

There are extra troubling indicators for the US greenback. Though central banks’ overseas alternate reserves have been rising steadily year-on-year for greater than 20 years, the share held in US {dollars} reached its lowest level within the fourth quarter of 2022, as this chart reveals:

US$ held by central banks

Writer offered utilizing Worldwide Financial Fund information., CC BY-NC-ND

This isn’t a blip. It’s the end result of an extended unfavourable pattern that has seen the US forex’s share in overseas reserves held by central banks fall from over 70% within the early 2000s to underneath 60% right this moment.

Whereas the drop shouldn’t be dramatic, it’s important and indicative of a unfavourable pattern for the greenback that displays a number of developments – financial but in addition geopolitical.

Leaving the US behind?

The US financial system’s share on this planet’s output is falling as rising economies, particularly China, proceed to outgrow the US and its western companions. China, the US’s largest financial competitor, is now the primary buying and selling associate to greater than 120 international locations, with exports amounting to greater than US$3.6 trillion (£2.8 billion). This dangers leaving the US behind within the race for international commerce dominance.

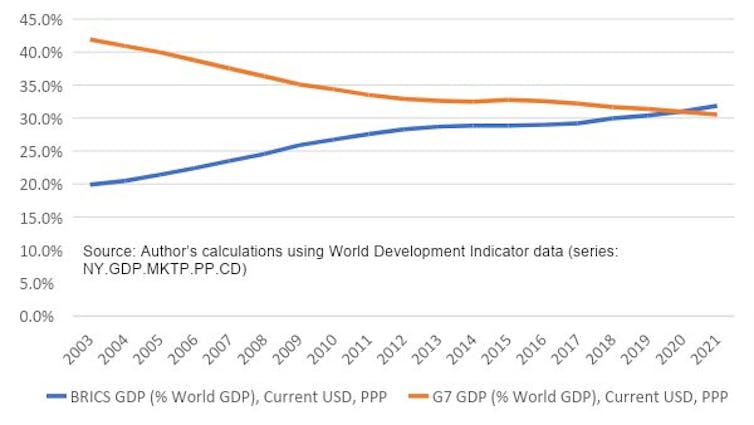

During the last 20 years, China’s share of the worldwide financial system has greater than doubled from 8.9% to 18.5% whereas the US’s share declined from 20.1% to fifteen.5% in buying energy parity phrases (which evaluate costs of particular items to find out forex buying energy).

Final 12 months, the Brics economies (fast-growth growing international locations Brazil, Russia, India, China and South Africa) overtook these of the G7 (developed economies US, Canada, UK, Germany, France, Italy, Japan and Germany) primarily based on their share of world GDP in buying energy parity phrases.

GDP: G7 v Brics

Writer offered utilizing World Improvement Indicator information (collection: NY.GDP.MKTP.PP.CD), World Financial institution, CC BY-NC-ND

As extra international locations be a part of the Brics, it is going to give the group much more financial clout.

In the meantime, the US financial system’s international GDP share is falling and its debt is hitting new heights because it points extra Treasury payments, notes and bonds to fund present authorities spending. The US nationwide debt stands in extra of US$33 trillion, or 123% of the nation’s annual output. Inflationary shocks adopted by rate of interest will increase have made servicing this debt very costly for US taxpayers, repeatedly elevating the chance of a debt default lately.

There isn’t a doubt the US greenback nonetheless dominates world markets proper now, accounting for many of the transactions in worldwide commerce. Its share within the overseas alternate market is colossal at 88% of transactions, and it stays essentially the most extensively held “worldwide reserve” by central banks who wish to guarantee they’ll cowl their international locations’ imports and assist the worth of their very own currencies.

However the centrality of the US forex because the second world conflict has not at all times been welcome –– actually not by US foes and generally not even by its buddies. Valéry Giscard d’Estaing, the twentieth president of France and a finance minister within the Sixties, known as the greenback’s reserve standing an “exorbitant privilege” for the US. He most likely meant that demand for US property from overseas was so excessive that it might borrow simply at beneficial phrases to finance its present account deficit –– a privilege not out there to different nations.

Present international geopolitical and financial shifts might now see this exorbitant privilege challenged. The refusal of Russia’s Brics companions and lots of UN nations to undertake western-style sanctions in opposition to Russia is proof of the constraints the west faces in exerting geopolitical affect.

And from an financial perspective, China because the world’s prime dealer and Russia as one of many world’s richest international locations by power reserves have amassed massive gold holdings which might change some US greenback makes use of. Each need to work with different international locations, together with these within the Gulf area, to cut back reliance on the US greenback.

Challenger currencies

Convincing non-western buyers to make use of a “challenger forex” – whether or not the Chinese language renminbi or a Brics forex – might develop into simpler following the US Treasury’s freezing of Russian property. And these switches might speed up if the US decides to grab the frozen Russian property.

It’s more and more clear that, as non-western international locations assert themselves on this planet’s financial area, geopolitical divisions with the west will trigger extra friction. In consequence, the US greenback’s position is sort of sure to develop into extra restricted than it has been at any time because the finish of the second world conflict.