Tariff wars are a recurring characteristic within the international buying and selling system, and tensions between China and Canada have been ongoing for years. These tariff wars are largely pushed by geopolitical tensions.

In 2019, for example, China banned Canadian meat imports following the detention of Huawei’s chief govt officer, Meng Wanzhou. Though China cited the usage of banned feed components in Canadian meat as the rationale, many considered it as a diplomatic response to the rift between Ottawa and Beijing.

Now, China is threatening to research Canada for potential dumping of canola into its market. In worldwide commerce, dumping is a sort of value discrimination the place a product is bought at totally different costs in home and export markets. Primarily, it entails promoting a product in a international market at a value decrease than its regular worth within the dwelling nation.

This resolution got here after Canada imposed a 100 per cent tariff on electrical automobiles and a 25 per cent tariff on metal and aluminum from China efficient Oct. 1, 2024. It’s clear this transfer by China is a direct retaliation for the tariffs on electrical automobiles.

Commerce tensions between international locations can severely disrupt worldwide commerce. My earlier analysis demonstrated how commerce tensions between Canada and america throughout Donald Trump’s presidency negatively impacted commerce between the 2 international locations, notably within the agri-food sector.

The mere risk of an anti-dumping obligation can discourage imports, making anti-dumping legal guidelines a type of non-tariff barrier, even when the obligation shouldn’t be really imposed. Though China has solely introduced a dumping investigation, the costs of canola oil futures are already being impacted.

THE CANADIAN PRESS/Jeff McIntosh

Anti-dumping procedures

As members of the World Commerce Group (WTO), each Canada and China are required to make sure their commerce insurance policies adjust to its laws.

Beneath the WTO framework, members can take motion towards dumping to guard their home markets. Nonetheless, such actions should comply with the established WTO protocols, together with submitting complaints by means of the group’s dispute settlement mechanism.

The WTO’s Anti-Dumping Settlement outlines how international locations can reply to dumping. On this case, China would want to show that Canada is dumping canola, quantify the extent of the dumping and reveal that it’s inflicting or threatening hurt to Chinese language canola farmers.

If China’s investigation uncovers proof of dumping, it has the correct to impose anti-dumping duties. These duties are utilized when dumping is confirmed and proven to have harmed the home trade.

The risk or imposition of such duties might considerably disrupt Canada’s canola exports to China, which might have critical implications for Canadian farmers who rely closely on international markets to promote their merchandise.

Canada’s canola export to China

Canada exports 90 per cent of its complete canola manufacturing, with exports of canola seed, oil and meal amounting to $15.8 billion in 2023. China is Canada’s second-largest importer of canola, after the U.S., with imports totalling $5 billion in 2023.

This implies China accounted for almost one-third of Canada’s complete canola export worth that yr. Notably, China is the biggest marketplace for canola seed, whereas the U.S. is the biggest marketplace for canola oil and meal.

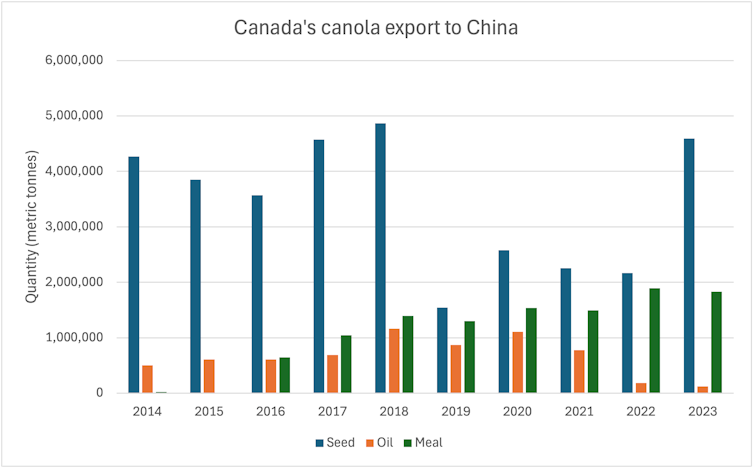

Canola is predominantly exported to China in its main kind (seed) moderately than as processed merchandise (oil and meal). The info reveals there have been secure exports to China from 2014 to 2018, however there was a pointy decline in canola seed exports beginning in 2019, which continued till 2023.

(Canola Council of Canada)

This drop coincides with a interval of diplomatic rigidity between Canada and China, suggesting that commerce disputes can have a major adverse impression on bilateral commerce. Thus, signalling the present commerce struggle might have devastating impact for canola farmers, particularly as China accounts for about 65 per cent of Canada’s canola seed export.

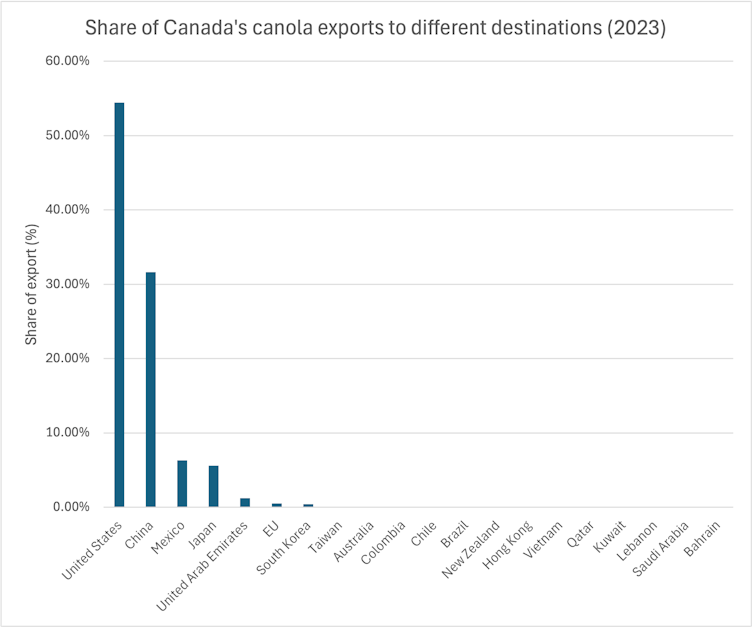

Moreover, Canada’s canola exports have proven restricted diversification, relying closely on simply 4 international locations: the U.S., China, Mexico and Japan. Collectively, these international locations accounted for 98 per cent of Canada’s complete export worth in 2023.

The U.S. led with imports value $8.6 billion, representing 54 per cent of Canada’s complete exports, adopted by China with $5 billion (32 per cent), Mexico with $1 billion (six per cent), and Japan with $883 million (5.6 per cent).

(Canola Council of Canada)

This heavy reliance on few markets heightens Canada’s vulnerability to commerce disruptions. If China imposes anti-dumping tariffs, this might make Canadian canola not aggressive within the Chinese language market, Canada might danger dropping 30 per cent of its canola export worth to different potential suppliers. The Canola Council of Canada has acknowledged China as an essential and valued marketplace for Canada’s canola.

What’s the best way ahead?

THE CANADIAN PRESS/Jeff McIntosh

Like many superior economies, Canada seeks to protect its home market from the inflow of low-cost Chinese language merchandise, akin to electrical automobiles. Nonetheless, Canada should train warning, notably when adopting commerce insurance policies from bigger economies just like the U.S. and the European Union.

These bigger economies maintain higher leverage in worldwide commerce negotiations, in contrast to Canada, a small open economic system that faces higher dangers in participating in a commerce struggle with China.

Furthermore, to help a swift transition to a inexperienced economic system and assist Canada meet its local weather goal of reaching 100 per cent zero-emission automobile gross sales by 2035, it’s important that electrical automobiles turn into extra inexpensive for the typical Canadian.

As an alternative of escalating commerce tensions with China, Canada ought to discover various measures akin to safeguards or tariff price quotas on Chinese language electrical automobiles. These approaches might be mutually helpful and fewer more likely to provoke a tit-for-tat retaliation.

Imposing a prohibitive tariff on electrical automobiles from China would come on the expense of different Canadian sectors that depend on Chinese language consumers. Canada should tread rigorously to keep away from sacrificing jobs within the agricultural sector whereas attempting to guard these within the vehicle trade.

Canola farmers, particularly, would possible bear the price of Canada’s unilateral tariff on China. Quite a few different sectors may be focused, as China would possible retaliate by matching the impression by itself exports.

Canada should attempt to reduce diplomatic tensions and keep away from commerce wars with main international market gamers, as such conflicts have gotten more and more frequent. Current commerce disputes, together with these with the U.S. throughout the NAFTA renegotiation, Saudi Arabia over human rights points and China following the detention of a Huawei govt, can considerably undermine Canada’s export competitiveness.