So the US President has set in movement his plan for so-called reciprocal tariffs.

We’ve mentioned this earlier than (See: Reciprocity for me, not you), however the crux of the proposal is that, topic to phrases and situations, the US will elevate its tariff on imports from any nation that imposes the next tariff, or equal tax and regulatory barrier, on US exports.

However, as per Trump’s Fact Social put up above, there may be an escape clause:

“… if a Nation feels that the US can be getting too excessive a Tariff, all they should do is scale back or terminate their Tariff towards us …”

Easy.

So, assuming you’re okay with eradicating your personal tariffs (and different measures Trump doesn’t like), how do you go about doing it?

To my thoughts, there are three broad classes of choices: authorized tariff discount; semi-legal tariff discount, and under no circumstances authorized tariff discount.

However first, what guidelines am I speaking about breaking?

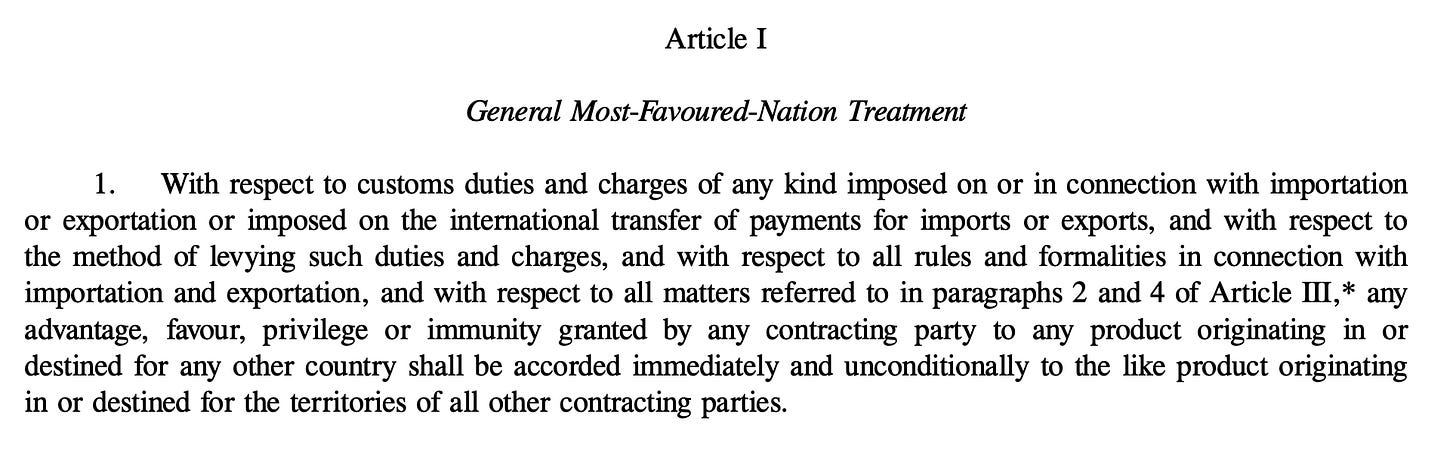

Most Favoured Nation (MFN), after all!

In addition to, extra famously, being the identify of this article, MFN is likely one of the core rules of the world buying and selling system and littered by the varied treaties that maintain it collectively.

Right here is MFN within the WTO GATT settlement:

In abstract, MFN requires that, topic to phrases and situations (as ever …), all WTO members deal with different WTO members the identical. By which I imply, it prevents, say, the UK from unilaterally reducing a tariff on imports from the US, however not from different nations too.

You possibly can most likely see the place I’m going with this …

Anyway, again to the matter at hand: the right way to dodge Trump’s reciprocal tariffs.

-

Authorized tariff discount

That is probably the most boring of the three choices, so I received’t linger on it for too lengthy.

-

Unilateral. You can unilaterally take away or scale back your tariffs to the identical degree because the US’s, however achieve this on a non-discriminatory/MFN-compliant foundation. For instance, the EU might scale back its 10 per cent MFN tariff on imported automobiles to 2.5 per cent to match the US 2.5 per cent tariff. On this instance, as a result of the EU has diminished the tariff to 2.5 per cent for all imports there is no such thing as a discrimination and all is properly. You can even argue that Trump has performed all the world a favour.

-

Bilateral. You can negotiate a complete free commerce settlement with the US. As long as it covers “substantively all commerce” (we’ll return to this in a second) then it’s nice to do a deal that removes or reduces tariffs on imports from the US, however not different nations. For instance, the EU might negotiate an FTA with the US that sees the EU scale back its automotive tariff to 2.5 per cent, and it might be beneath no obligation to supply this decrease tariff to automotive imports from different nations.

-

Semi-legal tariff discount

That is the place it will get extra enjoyable, no less than for me (perhaps not commerce legal professionals …). What do you do if you happen to kinda don’t wish to breach your worldwide obligations however you’re prepared to play issues a bit of extra quick and unfastened in an effort to give advantages to Trump/US exporters however not different individuals? Effectively …

-

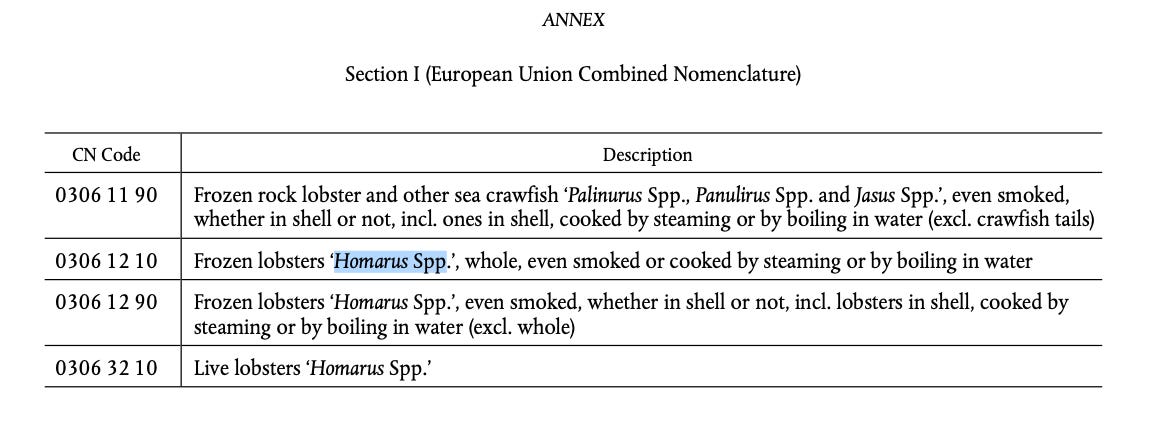

Unilateral. Right here there may be some proof of nations being barely cute. Whereas they’re obliged to use the identical tariff to all imports, regardless of their origin, what if you happen to solely scale back/take away tariffs on merchandise that originate the US? To take it a step additional, what if you happen to create customs codes that artificially differentiate between in any other case an identical merchandise that do and don’t originate within the US. If this sounds a bit of far-fetched, could I remind you that this occurred beneath Trump 1.0.

On 16 December 2020, in settlement with the US, the EU eliminated its MFN tariff on imported lobsters.

See:

The catch? The particular species the MFN tariff applies to—“Homarus Spp”—is native to North America. So, whereas the tariff removing is technically non-discriminatory, in actuality it solely applies to imports from the US (and Canada).

This time round, it seems like this kinda method could also be adopted by India in different sectors. Is it authorized? Ummm, ask a lawyer.

-

Bilateral. As talked about above, for an FTA to be compliant with a rustic’s WTO obligations, it should cowl “considerably all” commerce. In apply, who even is aware of what that truly means? [WTO/trade lawyers, I’m sorry. You can argue it out in the comments if it makes you feel better.] So, you would presumably do a take care of the US that removes/reduces your tariffs on a choose few merchandise in an effort to equalise them with the US tariffs. The upside of this method is that you just wouldn’t should unilaterally supply the identical liberalisation to the remainder of the world, too.

Once more, there’s a quasi-example of this from Trump 1.0. In September 2019, Japan agreed to cut back tariffs on US merchandise corresponding to pork and beef as a part of a mini deal. In return, the US eliminated some tariffs on some Japanese imports, corresponding to flowers, soy sauce and musical devices.

Did this settlement cowl “considerably all” commerce? Ummmmmmm. Ask a lawyer.

-

Under no circumstances authorized tariff discount

I don’t assume we have to overthink this one. Below this method a rustic would simply say “to hell with my worldwide obligations, I’m going to match my tariffs with the US’s for the US and for nobody else. Whatcha gonna do about it?”

And, properly, what’s anybody else really going to do about it? (Within the first occasion, most likely ask a lawyer, to be truthful …)

As per the Fact Social put up above, Trump’s workforce aren’t simply going to be taking a look at tariffs. They may also be attempting to place a tariff value on overseas regulatory boundaries to commerce.

In an accompanying truth sheet, the White Home lists EU restrictions on crustations for example of unfair commerce boundaries.

How shellfish.

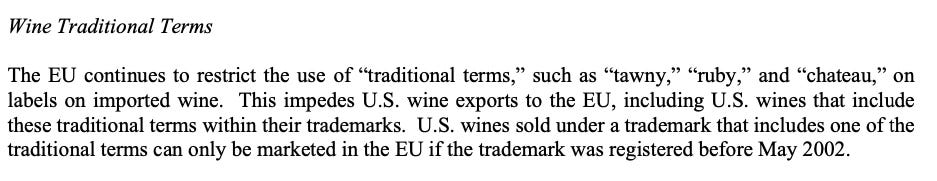

Anyhow, if you wish to get a way of what different overseas regulatory measures the US may be taking a look at, could I like to recommend studying my favorite annual report: the USTR Nationwide Commerce Estimate Report on International Commerce Limitations.

It consists of such classics as restrictions on hormone beef, most pesticide residue limits, and the MFN fan favorite, EU restrictions of “conventional phrases” when labelling wine:

[The observant among you will have noticed I’ve linked to the 2023 report, rather than the 2024 iteration. This is because the 2024 version had loads of stuff on digital trade restrictions stripped out to bring it more in line with Biden’s doemestic agenda and … yeah, I don’t think that’s very representative of the concerns of the Trump administration.]

With commerce wars again within the information, Chad Bown and his glorious podcast, Commerce Talks, is again. Comply with him on Bluesky right here.

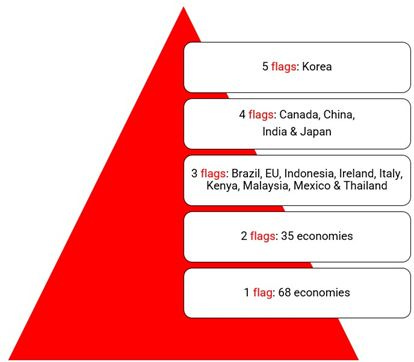

There are numerous alternative ways of mapping out which nations are most uncovered to Trump’s commerce antics. I beforehand did the MAGA Index, for instance. On that word, I loved Simon Evenett’s ‘Crimson Flag’ evaluation this week. Because the identify suggests, it makes use of a number of completely different metrics to evaluate which nations would possibly appeal to Trump’s wrath.

Learn the evaluation HERE.

Finest,

Sam